Baka corporation applies manufacturing overhead – Baka Corporation’s application of manufacturing overhead is a crucial aspect of their cost accounting practices. This analysis delves into the methods, impact, challenges, and optimization strategies related to overhead allocation, providing valuable insights for businesses seeking to enhance their cost management processes.

Manufacturing overhead allocation involves assigning indirect manufacturing costs to products or services, affecting product unit costs and profitability. By understanding the different allocation methods, their advantages and disadvantages, and common challenges, companies can refine their overhead allocation processes, ensuring accurate cost allocation and improved decision-making.

Manufacturing Overhead Allocation Methods

Manufacturing overhead costs are those indirect costs incurred in the production process that cannot be directly traced to specific units of output. Various methods are used to allocate these costs to products, each with its advantages and disadvantages.

Activity-Based Costing (ABC)

- Allocates overhead based on the activities that consume resources, such as machine setup, materials handling, and quality control.

- Provides a more accurate representation of the cost of each activity, leading to more precise product costing.

- Complex and time-consuming to implement, requiring detailed data collection and analysis.

Direct Labor Hours

- Allocates overhead based on the number of direct labor hours worked on each unit of output.

- Simple and easy to implement, with data readily available from timekeeping systems.

- May not accurately reflect the actual consumption of overhead resources, as some activities may not be directly related to labor hours.

Machine Hours

- Allocates overhead based on the number of machine hours used in the production process.

- Appropriate for industries with high levels of machine-intensive production.

- Can lead to distortions if machines are not used efficiently or if labor costs are significant.

Impact of Manufacturing Overhead on Product Costing

Manufacturing overhead is incorporated into product costing through the use of overhead allocation rates. These rates are calculated by dividing the total overhead costs by the selected allocation base (e.g., direct labor hours, machine hours).

Changes in overhead rates can significantly impact product unit costs. For example, an increase in the overhead rate will increase the cost of each unit produced, potentially reducing profitability.

Challenges in Manufacturing Overhead Application

Companies face several challenges in applying manufacturing overhead:

Inaccurate Data

- Incorrect or incomplete data on overhead costs and allocation bases can lead to inaccurate overhead rates.

- Can result in misallocation of overhead costs and distorted product costs.

Inconsistent Application

- Different departments or cost centers may apply overhead allocation methods inconsistently.

- Can create confusion and make it difficult to compare costs across different periods or products.

Complexity of Overhead Costs, Baka corporation applies manufacturing overhead

- Manufacturing overhead costs can be complex and difficult to categorize.

- Selecting the appropriate allocation method can be challenging.

Case Study: Baka Corporation’s Manufacturing Overhead Allocation: Baka Corporation Applies Manufacturing Overhead

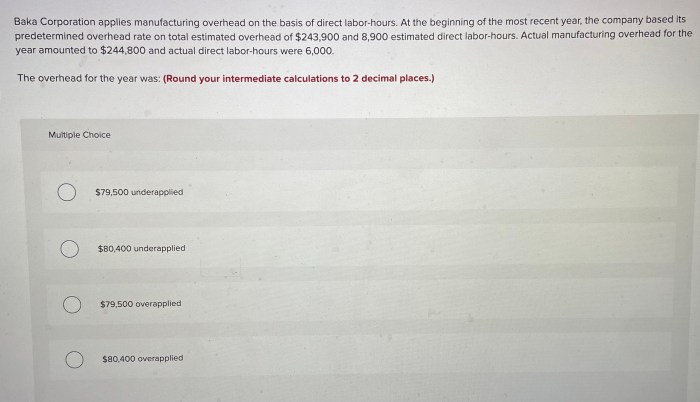

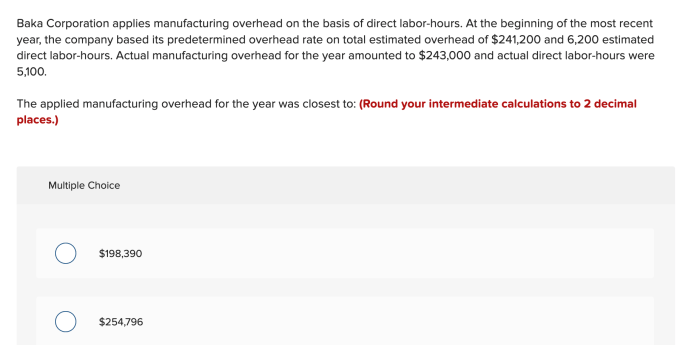

Baka Corporation is a manufacturer of electronic components. The company currently uses the direct labor hours method to allocate manufacturing overhead.

An analysis of Baka Corporation’s overhead costs revealed that a significant portion of overhead is related to machine setup and quality control. The company also found that the direct labor hours method was not accurately reflecting the consumption of overhead resources.

To improve the accuracy of its overhead allocation, Baka Corporation implemented an activity-based costing system. The new system resulted in a more equitable distribution of overhead costs and a more accurate representation of product costs.

Question Bank

What is the impact of manufacturing overhead on product costing?

Manufacturing overhead is incorporated into product costing through overhead allocation rates, which distribute indirect manufacturing costs to products. Changes in overhead rates can significantly impact product unit costs and profitability.

What are the common challenges in manufacturing overhead application?

Common challenges include inaccurate data, inconsistent allocation methods, and a lack of transparency. These challenges can lead to distorted product costs and incorrect decision-making.

How can companies overcome challenges in manufacturing overhead allocation?

Companies can overcome challenges by adopting activity-based costing, improving data accuracy, implementing robust cost allocation systems, and regularly reviewing and updating their allocation methods.